child tax credit october 2021 schedule

Below is the full Child Tax Credit payment schedule for the rest of this year as outlined by the IRS. Child Tax Credit Schedule 8812 H R Block Child Tax Credit Children 18 And Older Not Eligible 13newsnow Com October Child Tax Credits Issued Irs Gives Update On Payment Delays.

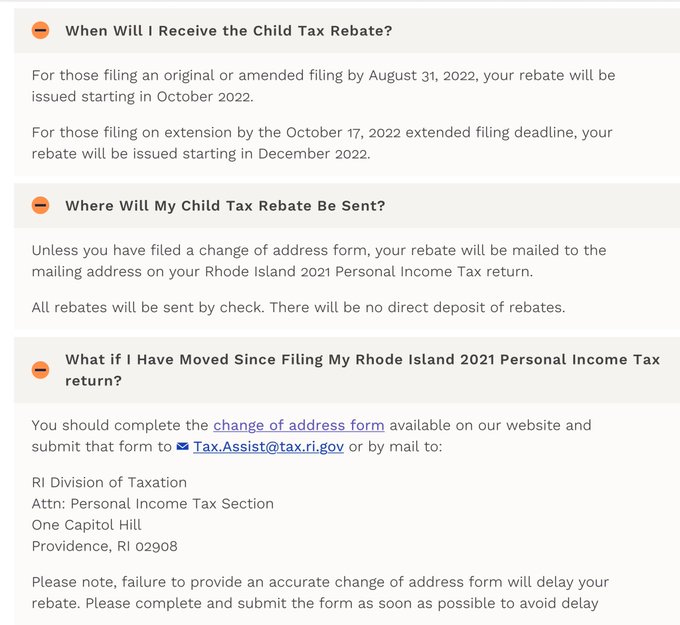

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

Hanges made to the USAs child tax credit system for 2021 mean that most qualifying families are able to receive half of their 2021 child.

. Three payments of the credit have already been sent out and three more are to come in 2021 with the next one due on October 15. Ad Complete IRS Tax Forms Online or Print Government Tax Documents. Child Tax Credit Dates.

The payments will be paid via direct deposit or check. But many parents want to know when. We dont make judgments or prescribe specific policies.

Eligible families can receive a total of up to 3600 for each child under age 6 and up to 3000 for each one ages 6 to 17 for 2021. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now receiving their advance Child Tax Credit CTC payment for the.

Each payment will be up to 300 for each qualifying child under the age of 6 and. 1400 in March 2021. Home 2021 credit october wallpaper.

Home of the Free Federal Tax Return. 1200 in April 2020. The IRS issued three Economic Impact Payments during the coronavirus pandemic for people who were eligible.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. See what makes us different. March 10 2022.

Ad Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly. The Child Tax Credit has been sent out since July and it has been. E-File Directly to the IRS.

CBS Detroit -- The fourth Child Tax Credit payment from the Internal Revenue Service IRS goes out tomorrow. For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to. The schedule of payments moving forward will be as follows.

112500 for a family with a single parent also called Head of Household. IR-2021-201 October 15 2021. Enter your information on Schedule 8812 Form 1040.

October 14 2021 726 AM MoneyWatch. The 500 nonrefundable Credit for Other Dependents amount has not changed. For 2021 only the child tax credit amount was increased from 2000 for each child age 16 or younger to 3600 per child for kids.

Next payment coming on October 15. Those who make 6000 or less could get a 500 refundable tax credit for each qualifying child under a bill pending approval by. The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying child.

But many parents want to know when. These payments were sent by direct deposit to a bank account or by mail as a paper check or a debit card. Here is some important information to understand about this years Child Tax Credit.

Child tax credit 2021 october Saturday April 2 2022 Edit. Families now receiving October Child Tax Credit payments. The IRS will send out the next round of child tax credit payments on October 15.

Wait 10 working days from the payment date to contact us. 600 in December 2020January 2021. You should receive the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than.

Ad Access IRS Tax Forms. October 14 2021 459 PM CBS Chicago. Still time for eligible families to sign up for advance payments.

Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. By Aimee Picchi. Part of the American Rescue Plan eligible parents can get half of their allowance before the end of 2021 and the.

The Child Tax Credit provides money to support American families. Child tax credit october 2021 schedule Thursday February 17 2022 Edit The Next Deadline For Opting Out Of The Monthly Child Credit Payments Will Be Here Soon Use The Irs S Child Tax Cred In 2021 Child Tax Credit Tax Credits Tax Deadline. 150000 for a person who is married and filing a joint return.

It also made the. Discover The Answers You Need Here. COVID-19 Stimulus Checks for Individuals.

To reconcile advance payments on your 2021 return. Thats an increase from the regular child tax credit of up. October 5 2022 Havent received your payment.

Complete Edit or Print Tax Forms Instantly. The fourth monthly payment of the enhanced Child Tax Credit landed in bank accounts Friday with anti-poverty researchers pointing to the. Ontario trillium benefit OTB Includes Ontario energy and property tax credit OEPTC Northern Ontario energy credit NOEC and Ontario sales tax credit OSTC All payment dates.

Child Tax Credit Payment Schedule for 2021.

Absence Of Monthly Child Tax Credit Leads To 3 7 Million More Children In Poverty In January 2022 Columbia University Center On Poverty And Social Policy

Pin On Banking Financial Awareness

Tax Exemption For Stillbirths Has A Much Deeper Meaning Than Money Now I Lay Me Down To Sleep Tax Exemption Tax Meant To Be

Childctc The Child Tax Credit The White House

Child Tax Credit Requirements To Obtain A New Direct Payment For Up To 750 Marca

Child Tax Credit 2022 How Much Money Could You Get From Your State Cnet

Gstr 1 Due Date October December 2020 Goods And Service Tax Goods And Services Udemy Coupon

Welcome You Are Invited To Join A Meeting Business Ense Boot Camp After Registering You Will Receive A Confirmation Email About Joining The Meeting Accounting Education Webinar Business Funding

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

Don T Wait Important Information From The Irs If You Re Waiting To File Your 2021 Tax Return Internal Revenue Service

Gstr Due Dates Dec 2018 Goods And Service Tax Due Date Accounting Software

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

2021 Child Tax Credit Advanced Payment Option Tas

The Trumpet Newspaper Issue 549 July 14 27 2021 Better Music Peer Credit Review