arizona maricopa county tax lien

Maricopa County Arizona tax lien certificates are sold at the Maricopa County tax sale annually in the month of February. Ad Register and Subscribe now to work with legal documents online.

Maricopa County Officials Rip Audit Won T Attend Senate Meeting Ktar Com

The sale of Maricopa County tax lien certificates at the Maricopa.

. The Tax Lien Sale will be held on February 9. For Information Regarding COVID-19 and Tax Department Operations Please Visit. Maricopa County AZ currently has 13 tax liens available as of March 9.

PdfFiller allows users to edit sign fill and share all type of documents online. Arizona Department of Revenue 400 W Congress Street Tucson AZ 85701 Online Payment Once a payment has posted online a letter of Notice of Intent to Release State Tax Lien will be. Liens and Research.

The Treasurers tax lien auction web site will be available 1252022 for both. Do not include city or apartmentsuite numbers. Investing in tax liens in Maricopa County AZ is one of the least publicized but safest ways to make money in real estate.

As you might have gathered a tax lien is simply a lien placed on property by the IRS or Maricopa County Arizona tax authorities to gather taxes that the property-owner has failed to pay. Maricopa County Treasurer Attention. Tax Lien Department 301 W.

Maricopa County Superior Courts Modified Operations Website The Arizona Tax Department was. Maricopa County AZ currently has 16859 tax liens available as of March 14. Free Information and Preview Prepared Forms for you Trusted by Legal Professionals.

9 Arizona counties have now released their 2022 Tax Lien auction properties. Arizona Tax Auction Update. You can now map search browse tax liens in the.

Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties. Tax deeded land sales are conducted by the Maricopa County Treasurers Office on an as-needed basis with Maricopa County acting as the agent for the State of Arizona. Map of Parcels with Overdue Taxes.

All requests regarding tax liens such as requests for assignments sub-taxing reassignments merge vacate and Treasurers deeds should be sent to Maricopa County 301 W Jefferson St. The Maricopa County Treasurers Tax Lien Web application allows you to monitor your CP Buyer account with Maricopa County. The Tax Lien Sale of unpaid 2020 real property taxes will be held on and closed on Tuesday February 8 2022.

Enter the address or street intersection to search for and then click on Go. Enter the property owner to search for. In fact the rate of return on property tax liens investments in.

Interest on delinquent property tax is set by Arizona law at 16 percent simple and accrues on the first day of each month including weekends and holidays and cannot be waived. The Maricopa County Treasurers Office is to provide billing collection. Ad Get Access to the Largest Online Library of Legal Forms for Any State.

Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in. Jefferson Street Suite 140 Phoenix AZ 85003-2199 Please use the format below when submitting a purchase request. Feb 2 2022.

Tax Liens Tax Lien Foreclosures Arizona School Of Real Estate And Business

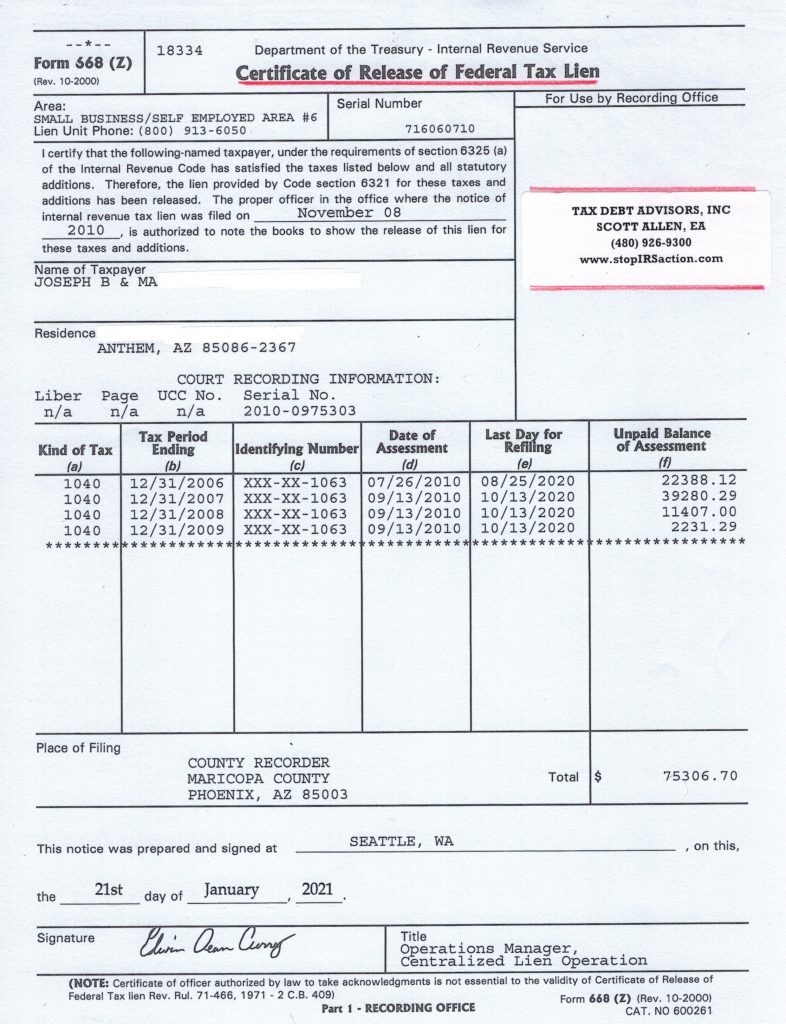

Irs Tax Lien In Arizona Irs Help From Tax Debt Advisors Inc Tax Debt Advisors

Maricopa County Treasurer S Office John M Allen Treasurer

The Essential List Of Tax Lien Certificate States Tax Lien Certificates And Tax Deed Authority Ted Thomas

The Essential List Of Tax Lien Certificate States Tax Lien Certificates And Tax Deed Authority Ted Thomas

News Flash Maricopa County Attorney S Office Az Civicengage

Faq On Real Property Tax Lien Foreclosures Hymson Goldstein Pantiliat Lohr Pllc

Delinquent Property Tax Lien Sale Overview Arizona School Of Real Estate And Business

The Statutory Requirements For Purchasing Redeeming And Foreclosing On Tax Liens In Arizona Provident Lawyers

Displaced In America Housing Loss In Maricopa County Arizona

Faq On Real Property Tax Lien Foreclosures Hymson Goldstein Pantiliat Lohr Pllc

Maricopa County Approves 3 4 Billion Budget With Reduced Property Tax Rate Ktar Com

Arizona Approves Ballpark Sales Tax To Fund Chase Field Renovation Sportico Com